Flat tax

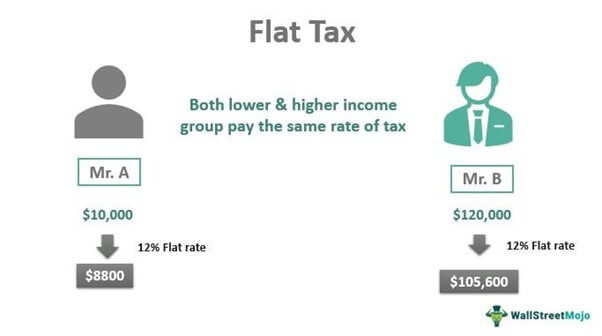

A pure flat tax applies the same tax rate to all types of income. In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses.

Dick Armey Steve Forbes S Plot To Raise Taxes On Most Texans Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Amended tax returns not included in flat fees.

. Properties reflecting a variation with tax assessed being 10 percent or more above the samplings median level will be pinpointed for. Mississippi will have a flat tax as of next year with a 4 percent rate by 2026. La Flat Tax aussi appelée Prélèvement.

Governor Ducey signed the historic tax package into law last year further. Some states add a. Flat taxes are typically a flat rate rather than a flat dollar amount.

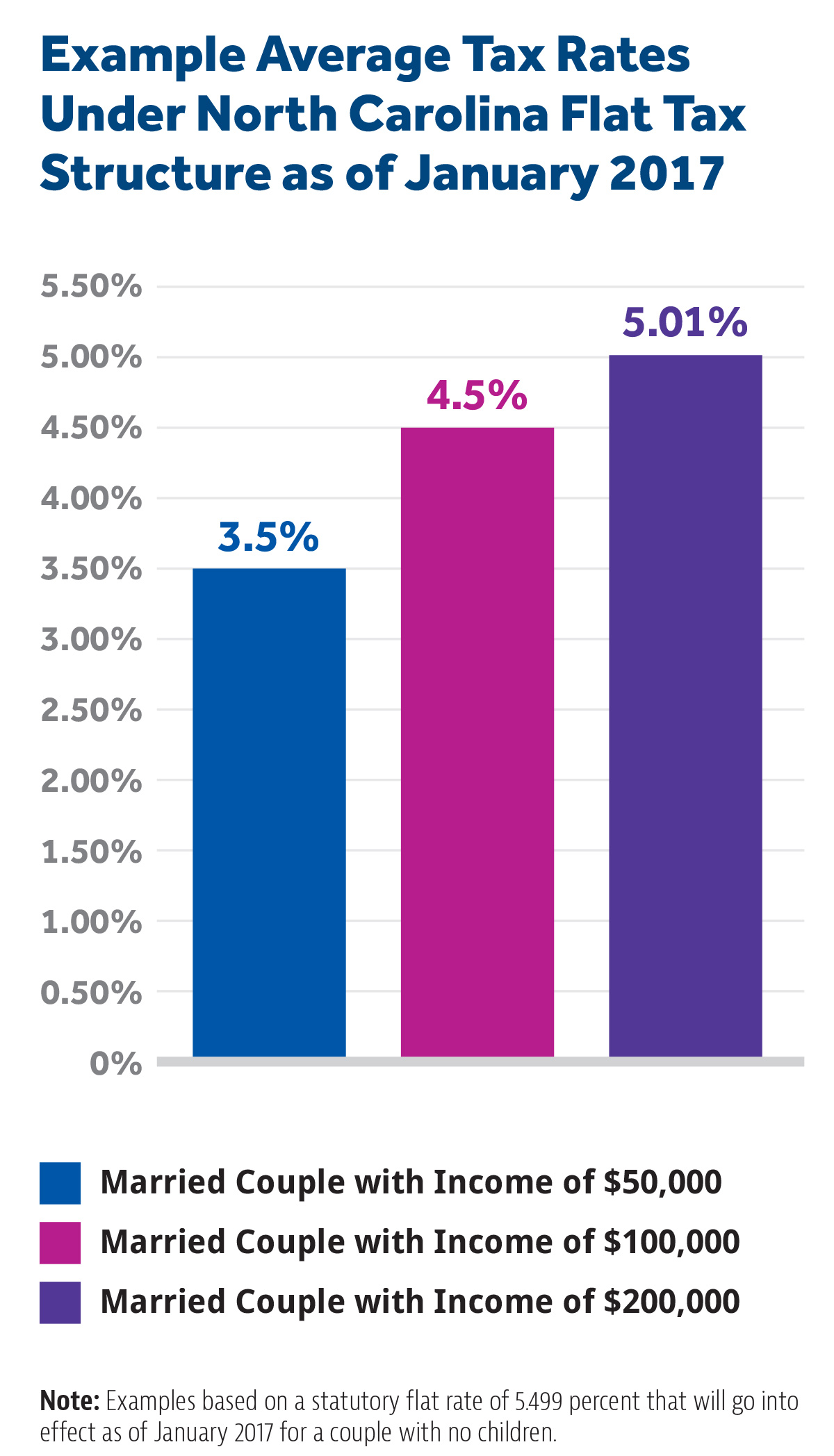

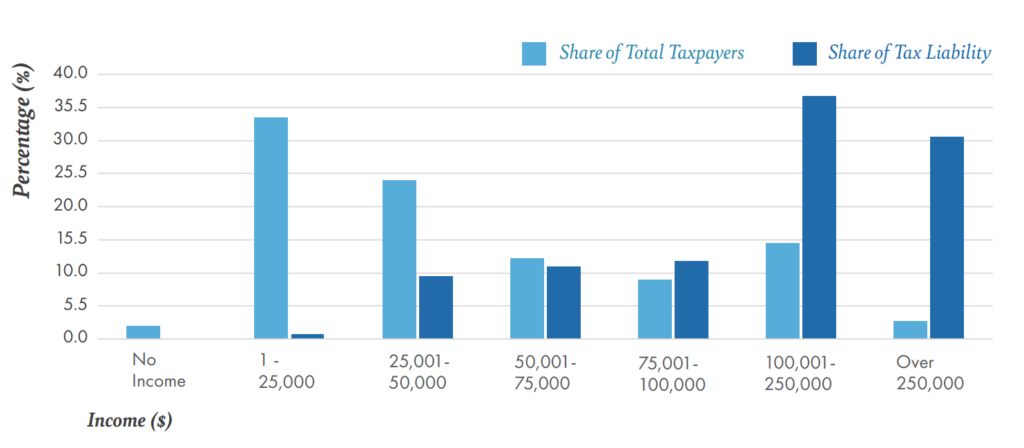

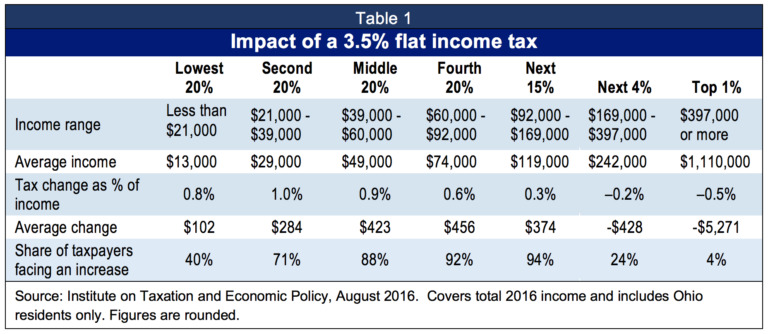

Typically a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed but some politicians have proposed flat tax systems that keep certain deductions in place. A separate agreement is required for all Tax Audit Notice Services. A flat tax to its critics is much more likely to hurt the poor and benefit the rich by taking more of a bite out of low-income folks budgets.

Flat rate taxes only one income and that makes it easier to understand and. And then the Courts that failsafe of the political and corporate. A flat tax system applies the same tax rate to every taxpayer regardless of income bracket.

A flat tax is used when the same tax rate is applied to every taxpayer irrespective of income level. Tax Audit Notice Services include tax advice only. Consult your own attorney.

Most flat tax systems or. However many flat tax regimes have. It was passed on the promise of property tax relief.

Flat taxes are when everyone pays the same amount regardless of income. These candidates tax assessments are then matched. Therefore except for the exemptions the economic.

With enactment of the flat tax in 94 days on January 1 Arizona will have the lowest flat tax in the nation. Local and long distance You name the destination well take you there. Local or long distance our experienced drivers will always be there to assist you in getting you to your destination on time.

Why notThe tax is a scam based on a lie. Georgias income tax is now scheduled to convert to a flat rate of 549 percent eventually. It wouldnt give tax filers a hard time and those at the IRS would welcome the easy computation.

Bien que son nom paraisse anglophone la Flat Tax est un impôt français mis en place en 2018 sous le gouvernement Macron.

Flat Tax States Ff 11 02 2020 Tax Policy Center

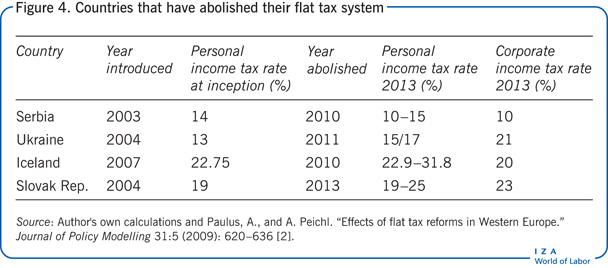

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets

The Flat Tax Revolution Gains Steam John Steele Gordon Commentary Magazine

Flat Tax Revolution Using A Postcard To Abolish The Irs Forbes Steve 9780895260406 Amazon Com Books

Cruz S Flat Tax Vat Would Cut Revenues By 8 6 Trillion Tax Policy Center

Flat Tax Definition Examples Features Pros Cons

The Case For Flat Taxes The Economist

Worthwhile Canadian Initiative Canada Already Has A Flat Tax

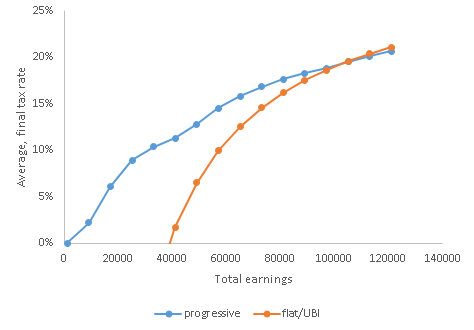

Progressivity And The Flat Tax

Arizona S 2 5 Flat Tax Going Into Effect A Year Ahead Of Schedule Phoenix Business Journal

Progressive Tax States Lose People Income To Flat And Zero Income Tax States Wirepoints Wirepoints

Mississippi Becomes Third State This Year To Move To Flat Tax The Sentinel

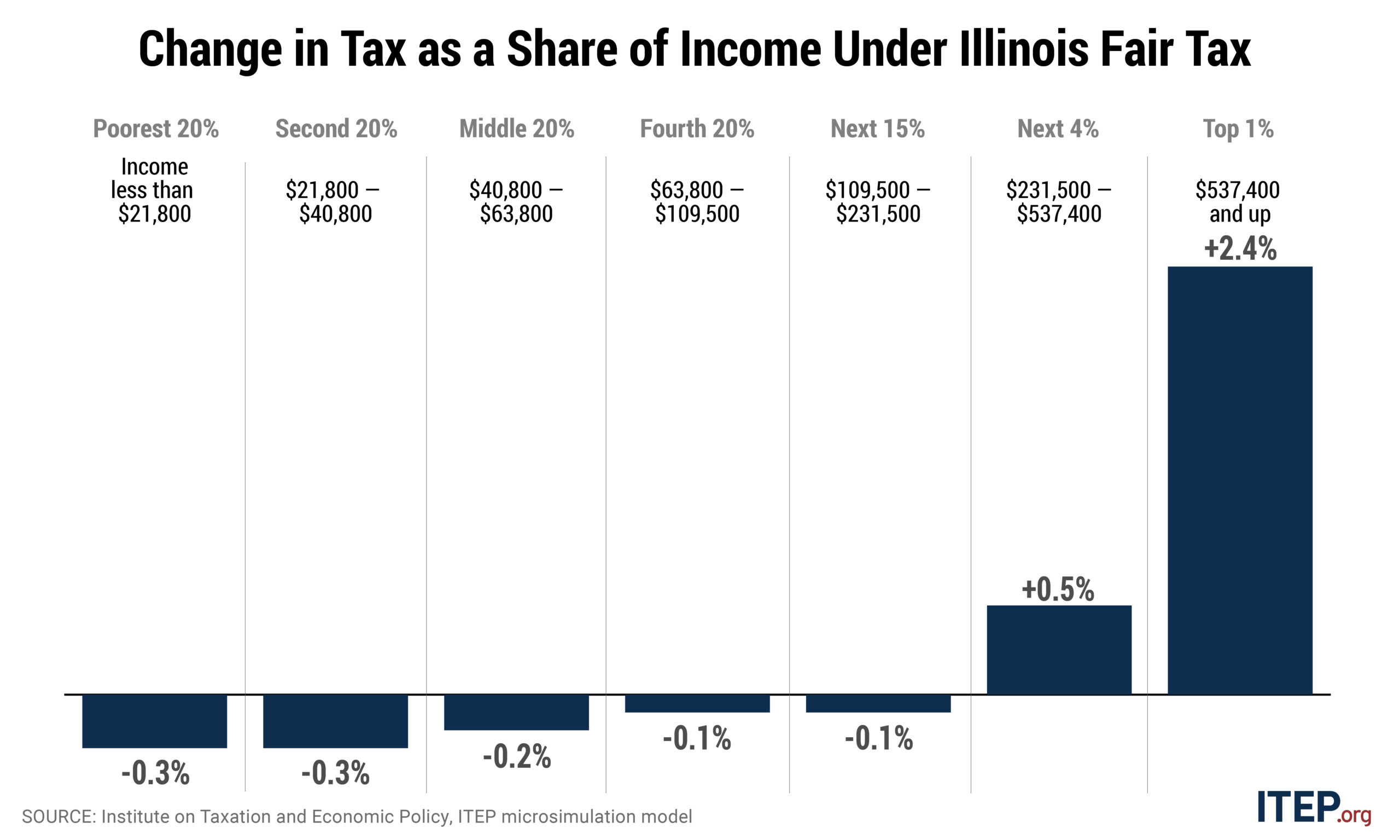

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

Flat Tax Would Mean More Taxes For Most

Iowa Senate Republicans Release Flat Tax Proposal With Road To Elimination The Daily Iowan

Universal Basic Income Plus A Flat Tax Equals A Progressive Tax By Peter Allen Medium

Flat Tax Backed By Majority Of Iowans Not Corporate Cuts Iowa Poll

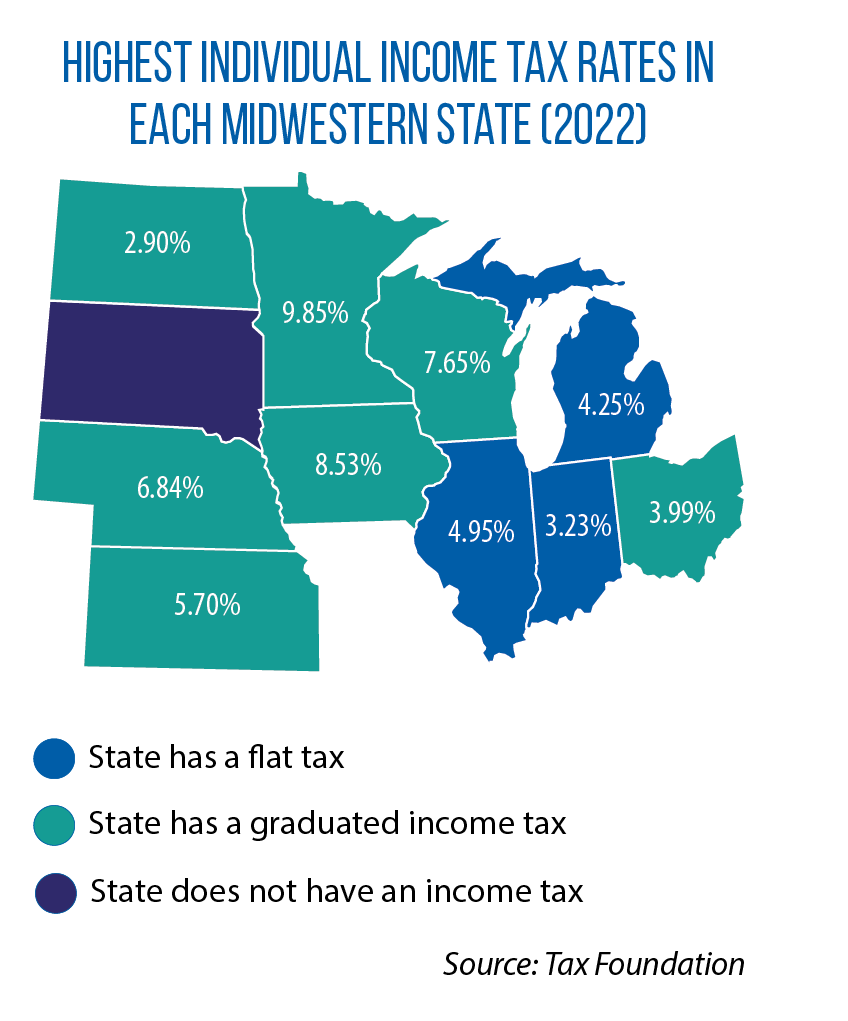

Iowa Switching To Flat Income Tax System Joining Three Other States In Midwest Csg Midwest